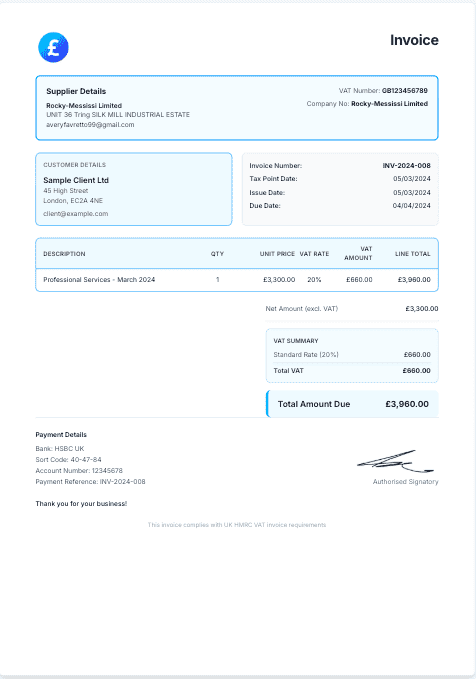

Value Added Tax (VAT) is levied on the sale of goods or services by UK businesses.

VAT is collected on behalf of HM Revenue & Customs by companies. A company pays VAT to HMRC by calculation the amount of VAT charged to customers minus any VAT they have paid on their own purchases.

All goods and services are either VAT-rated or VAT-exempt. VAT-exempt items include rent, private education, health services, postal services, finance and insurance, and gambling.

A business must register for VAT once the sales exceed £67000 (as of 1st April 2008) in a year, or else you can make a voluntary registration even before hitting this threshold.

VAT is charged on goods at different levels. The current standard rate of 20% applies to most items.

A Reduced Rate of 5% applies to many items including mobility aids for the elderly, smoking cessation products (nicotine patches and gum), electricity and gas for domestic and residential use, children's car seats, booster seats and booster cushions and many more.

Finally, there is a Zero Rate on many items, including but not limited to - Cycle helmets (CE marked), Protective boots and helmets for industrial use, children's clothes and footwear, baby wear, printing of brochures, leaflets and pamphlets, aircraft repair and maintenance, building services for disabled people.

More details can be found here:

http://www.hmrc.gov.uk/VAT/forms-rates/rates/goods-services.htm