The Flat Rate Scheme for VAT is available to businesses who have an annual VAT taxable turnover of less than £150,000. The flat rate scheme can reduce the time needed to complete accounting tasks and calculating tax.

Using standard VAT accounting, the VAT you pay to HMRC (or claim back) is the difference between the VAT you charge and the VAT you pay.

Using the Flat Rate Scheme you pay VAT as a fixed percentage of your VAT inclusive turnover. The actual percentage you use depends on your type of business.

The Flat Rate Scheme can save time and smooth cash flow.

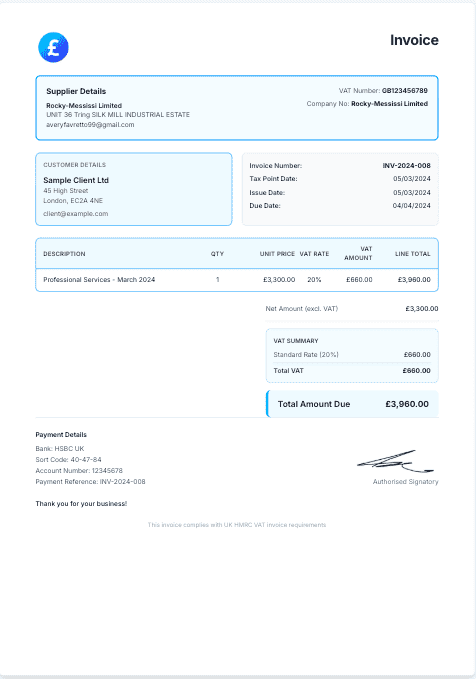

You don't have to record the VAT that you charge on every sale and purchase meaning you spend less time on your accounts, and more time on your business. You still need to show VAT on your invoices as you do for normal VAT accounting.

In your first year of VAT registration you get a one per cent reduction in your flat rate percentage until the day before the first anniversary you became VAT registered.

You no longer have to work out what VAT on purchases you can and can't reclaim.

With less chance of mistakes, you have fewer worries about getting your VAT right.

You always know what percentage of your takings you will have to pay to HMRC.

Potential disadvantages of using a Flat Rate Scheme

The flat rate percentages are calculated in a way that takes into account zero-rated and exempt sales. They also contain an allowance for the VAT you spend on your purchases. So the VAT Flat Rate Scheme might not be right for your business if:

- you buy mostly standard-rated items, as you cannot generally reclaim any VAT on your purchases

- you regularly receive a VAT repayment under standard VAT accounting

- you make a lot of zero-rated or exempt sales.

The flat rate scheme is not advisable for all businesses. It is best to consult the VAT section of the HMRC website or speak to an accountant:

http://www.hmrc.gov.uk/VAT/start/schemes/flat-rate.htm